Case Study – RSA

Risk Insight enables RSA to better manage the risk profile of broker business

Case Study – RSA

Risk Insight enables RSA to better manage the risk profile of broker business

Executive summary and key facts

With a 300-year heritage, RSA is one of the world’s leading multinational insurance groups. Focussing on general insurance, RSA’s core markets are the UK and Ireland, Scandinavia and Canada with the capability to write business across the globe. RSA has around 13,500 employees across its core business serving over 9 million customers in more than 100 countries. Its focus on general insurance has delivered strong, profitable performance, even in the most challenging market conditions. In 2015 its net written premiums were £6.8bn. The GeoRisk team is part of RSA’s Global Centre of Excellence and offers services across the whole of the RSA business. The team is headed up by Rob Osment, Global GeoRisk Director.

What was the business problem that needed to be solved?

RSA had been using property level risk assessment since 2001 with peril scoring and mapping being delivered to underwriters through an internally developed suite of tools. For brokers, risk data was delivered through the supply of a postcode level tool which provided risk scores only. The challenging weather and subsequent floods of the last few years, clearly demonstrated the acute limitations of the postcode-based approach. This provided the motivation to implement a new property level risk assessment tool for brokers which provided them with the same level of detail enjoyed by RSA underwriters. RSA’s key requirements were to deliver and implement the new tool within three months of approval, whilst utilising the services already provided by Europa Technologies and RSA’s internal risk models. The key benefits of this approach were:

- A consistent view of risk across all areas of RSA’s business

- Fewer referrals back to RSA as brokers can access the relevant level of detail

- Improved efficiencies since the postcode tool no longer needs to be maintained

- A much quicker process to provide effective tools to RSA’s brokers

- Minimal maintenance overheads as internal RSA models are utilised

Historically, RSA would have built the application internally – never before had the company deployed an application externally. As a result, the potential issues of security, confidentiality and authentication had to be carefully considered. In particular, it was essential that only authorised users could access the application and that usage could be carefully monitored. It was also important that access could easily be revoked for users who no longer needed it. The overriding issue was one of speed, particularly in the light of the level of flood claims received by January 2016. Consequently, the business was keen to make sure that brokers could start to benefit from the property level tool as soon as possible. With clear financial justification, the requirement was to find a supplier with expertise in this arena, who could implement an effective solution quickly. In the words of Rob Osment, Global GeoRisk Director, RSA: “We needed to find an expert supplier – one we felt comfortable with on a personal level, and who also had the knowhow and we were certain would deliver.”

What was the solution?

Time was of the essence with a solution required within a few months. Fortunately, Europa Technologies had an existing solution for precision risk assessment called Risk Insight. Risk Insight was already being used by other insurers to accurately score and visualise risk using perils data sets such the JBA Comprehensive Flood Map and the BGS GeoSure Insurance Product. Risk Insight’s flexible platform could be tailored to RSA’s specific requirements. This included utilising the AddressCloud service for fast and effective matching of addresses against AddressBase Premium. RSA was keen to share these benefits with its brokers. It was also important that brokers would have access to the same risk models as were used internally by RSA. Europa Technologies was able to quickly load these into the Risk Insight platform so that they were ready for use on day one. Additionally, Risk Insight utilised the viaEuropa hosted map service for the visualisation of Ordnance Survey base maps. viaEuropa was already widely used within RSA’s internal web and desktop applications to simplify the process of displaying high quality base maps. Using viaEuropa in this new application was the obvious choice. Importantly, this approach enabled RSA and Europa Technologies to meet all key requirements, including the challenging deadline. By building on an existing platform, RSA benefitted from savings in both development cost and time.

“The Europa Technologies approach is agile, innovative and always looking to add value.”

Why was Europa Technologies selected?

RSA already had a strong working relationship with Europa Technologies, who provided Ordnance Survey data and a number of complementary hosted services. By implementing a solution based on Risk Insight, RSA felt confident that Europa Technologies would provide an innovative and agile solution on time. Additionally, RSA appreciated the customer centric approach of the Europa Technologies team, demonstrated through innovation and planning workshops to quickly determine the scope of the ‘minimum viable product’. This approach would enable RSA to provide brokers with the most important functionality first and deliver additional functionality in later phases.

“By selecting Europa Technologies, we knew no challenge would be left unanswered.”

How was it implemented?

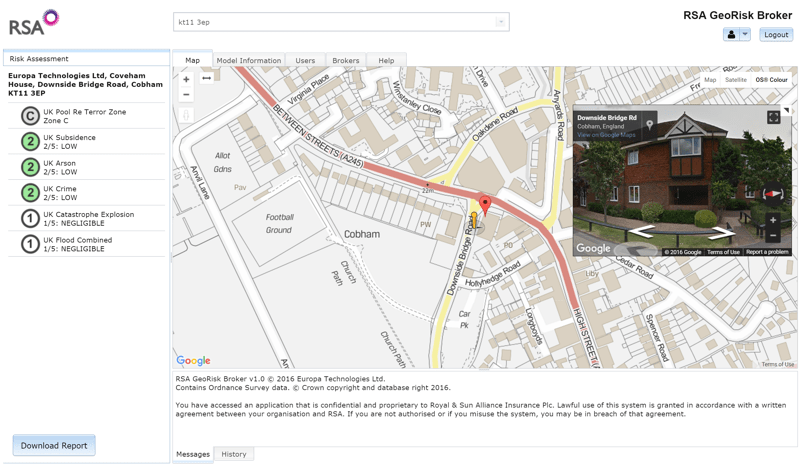

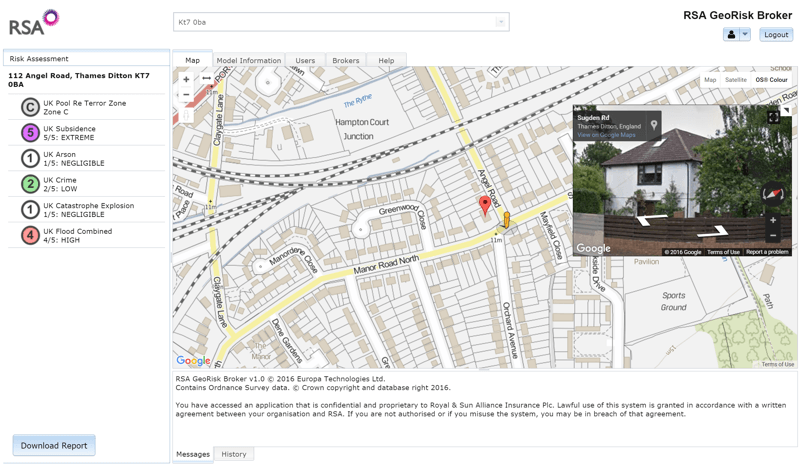

Risk Insight was adapted and rebranded to form the bespoke RSA GeoRisk Broker application. The implementation already supported services previously selected by RSA, including viaEuropa (hosted Ordnance Survey maps) and AddressCloud (a high performance, cloud-based, geocoder and search engine). The project was undertaken in phases and managed under formal project governance by RSA. After the release of an initial version, standard testing and deployment processes were followed before making the application live. GeoRisk Broker was rolled out to RSA’s brokers in stages, with a pilot group the first to receive access. The pilot provided important feedback not only on the functionality and usability of the application, but also on the user registration process. Initial feedback was used to simplify and streamline the process so that registered users were quickly up and running. The availability of user logs meant that the internal RSA project team could keep a close eye on levels of uptake.

What were the results and benefits?

GeoRisk Broker has provided a functional, cost effective tool for RSA’s broker-based business. Precision risk assessment offers significant benefits to RSA, their brokers and customers through better informed underwriting. The transition from spreadsheets distributed biannually, to a web-based service, provides significant benefits in terms of maintenance since risk models can be centrally upgraded as required. This eliminates the danger of a broker using out-of-date information and provides user access control and comprehensive activity monitoring. From the brokers’ point of view this project represents a massive step forward in terms of effective and accurate underwriting, and importantly is easy to use. One of the first brokers to use GeoRisk Broker commented “By selecting the accurate address of the risk, it allows you to view Google Street View immediately, saving time checking the premises itself. The rating is given in more detail too which helps with understanding the risk better”. Above all, RSA will be able to measure the performance of its portfolio through future flood events.

“We knew we had to improve our systems and do so quickly, so that our brokers could benefit from improved risk assessments, especially for flooding. GeoRisk Broker will ultimately help to improve the profitability of our business. Europa Technologies has risen to the challenge and enabled us to meet it.”

What are the next steps?

The initial success of the application has led RSA to investigate how GeoRisk Broker could be used more widely across the organisation. One part of the business which could benefit further is Commercial Lines where there is a need to be able to quickly assess the level of risk for an entire portfolio. In response to this, a batch mechanism is being developed to meet this secondary requirement. It is expected that the application will evolve to meet the growing needs of the organisation. Another important area is the presentation of management information so that KPIs and other key metrics are available quickly and intuitively to those that need them. Dashboards and reporting templates are being designed to assist in this process

About Europa Technologies

Europa Technologies offers a broad spectrum of products and services for the Insurance sector, ranging from a single piece of the jigsaw to a complete solution.

- Our managed data supply service includes data sets such as Ordnance Survey mapping for Great Britain and our own global CRESTA zones.

- The viaEuropa hosted map service (as used by RSA) can provide access to base mapping and perils data as a service.

- The Risk Insight platform provides a comprehensive risk assessment solution presenting a clear picture of risk and exposure across your organisation.

Europa Technologies is an award-winning specialist in digital maps and associated services for a wide variety of market sectors and applications. Our resources allow organisations with international interests to better understand their customers, assets and markets, in a geographic context, to gain a competitive or strategic advantage. Mapping products and services from Europa Technologies are used by many Fortune Global 500 companies, governments and missions of the United Nations. The company has global licence agreements with a number of leading Internet-based service providers including Google. Through deployment via Google Earth and Google Maps alone, our world data products have been seen by over one billion people, approximately 1 in 7 of the world’s entire population. For further information on our products and services for the Insurance sector, including a demonstration of the Risk Insight platform, please contact us today.

How can we help you?

If you have any questions about this case study, please contact a member of our team who will be happy to help you.